We’re barely into the second month of 2021, and the United States’ CBD industry has already seen one set of crucial regulations announced, and another pulled back for rewrites. CBD farmers caught a break with the USDA regulations that were published on January 15, which drastically lowered operating costs (among other improvements). CBD distributors, on the other hand, saw some long-anticipated FDA regulations withdrawn by the Biden administration.

So, what does this mean for the CBD industry? Let’s get into the details.

The USDA published regulations that gave most cannabis farmers a big break on production costs

Ever since state after state began legalizing cannabis, federal regulation has been noticeably lacking. Once the USDA finally established some interim regulations, farmers discovered that they entailed steep costs that could have easily been avoided.

Perhaps the biggest complaints involved the way in which “hot hemp” was handled. In the context of the cannabis industry, hemp is cannabis that contains very low THC – 0.3% or less.

Hot hemp is anything that goes above that limit; farmers can’t sell it, so it has to be destroyed in order to keep it from being sold via illegal channels.

Under the interim rules, farmers were required to call law enforcement personnel who were authorized to exterminate Schedule 1 substances. This cost farmers an average of $200/acre, which was a hefty addition to all the other expenses related to growing hemp.

With the new regulations, though, farmers are allowed to dispose of their hot hemp themselves, at a cost of less than $15/acre.

The main requirements are that the plant material is rendered unusable through burning, plowing into the ground, composting/mulching for fertilizer, or covering with soil.

Farmers also have to make accurate reports to the state authorities of all their hot hemp they dispose of; the state then has to send the information to the federal government within a month.

The USDA regulations don’t require the same process or documentation with cannabis that’s under the 0.3% limit and has to be destroyed for other reasons, like disease, infestation, weather events, overall poor health, or the removal of hermaphrodite or male plants to prevent cross-pollination.

Since the THC content is too low to make it a candidate for theft, it’s up to the farmers to destroy it however they prefer. If a farm is USDA-licensed, however, it still has to rely on law enforcement to destroy their hot hemp.

The FDA had to pull their CBD policy from the approval process, setting back the regulation of CBD drug products for months

The main players here are the U.S. FDA (Food and Drug Administration), the White House OMB (Office of Management and Budget), and the Biden administration – specifically the change in administration. In July of last year, the FDA submitted the Cannabidiol Enforcement Policy Draft Guidance for Industry for approval by the OMB.

Unfortunately, the OMB didn’t make a decision before the end of the Trump administration; the day after Biden’s inauguration, his administration informed all the federal agencies that pending rules were to be withdrawn. All of these rules, including the FDA’s policy for the CBD industry, were developed under the previous administration, and probably wouldn’t match Biden’s ideas.

Even though the OMB had already held discussions with CBD retailers and makers, like General Nutrition Centers (GNC) and GW Pharmaceuticals, the OMB’s process will likely have to start from the beginning once the FDA submits their new policy draft.

Nobody knows how long it will be before the FDA can rewrite the policy, let alone how long the OMB will take to approve it; after all, it took the FDA over a year to write the first policy. However, it’s likely that once OMB approval happens, the new regulations can be announced just weeks afterwards.

Everyone saw this delay coming from miles away, but it’s still frustrating for a lot of people. The need for regulating the production and distribution of pharmaceutical CBD has been obvious for quite a while, so the idea of having to start the approval process all over again isn’t easy to deal with.

Regardless of how the policy deals with the finer points of the CBD industry, it will definitely influence the policies that are enacted in the future.

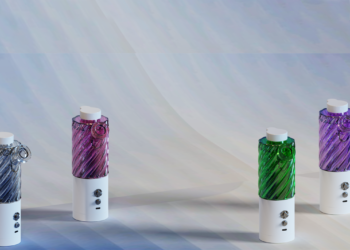

This will deal specifically with over-the-counter cannabis products, but regulation will also be needed for products like CBD dietary supplements or ingestible tinctures such as the black pepper turmeric CBD oils from Pachamama CBD.

There are already large sections of the industry that are operating in legal gray areas, and regulators are concerned that things could start going in the wrong direction if left to operate on their own for too long.

This is a setback, for sure, but on the other side of the coin, it’s a sign that the industry is flourishing.

It’s been less than three years since cannabis was legalized for consumption in the US, and it’s already big enough to experience some significant growing pains. One thing is certain: as the CBD industry grows, the need for regulation will grow along with it.